Assistant Professor of Finance

The University of Texas at Dallas

Naveen Jindal School of Management

800 W. Campbell Road

Richardson, TX 75080

E-Mail: meier@utdallas.edu

SSRN-Page

Google Scholar Profile

ORCiD Profile

Twitter Profile

LinkedIn Profile

Curriculum Vitae (Opens pdf in new window)

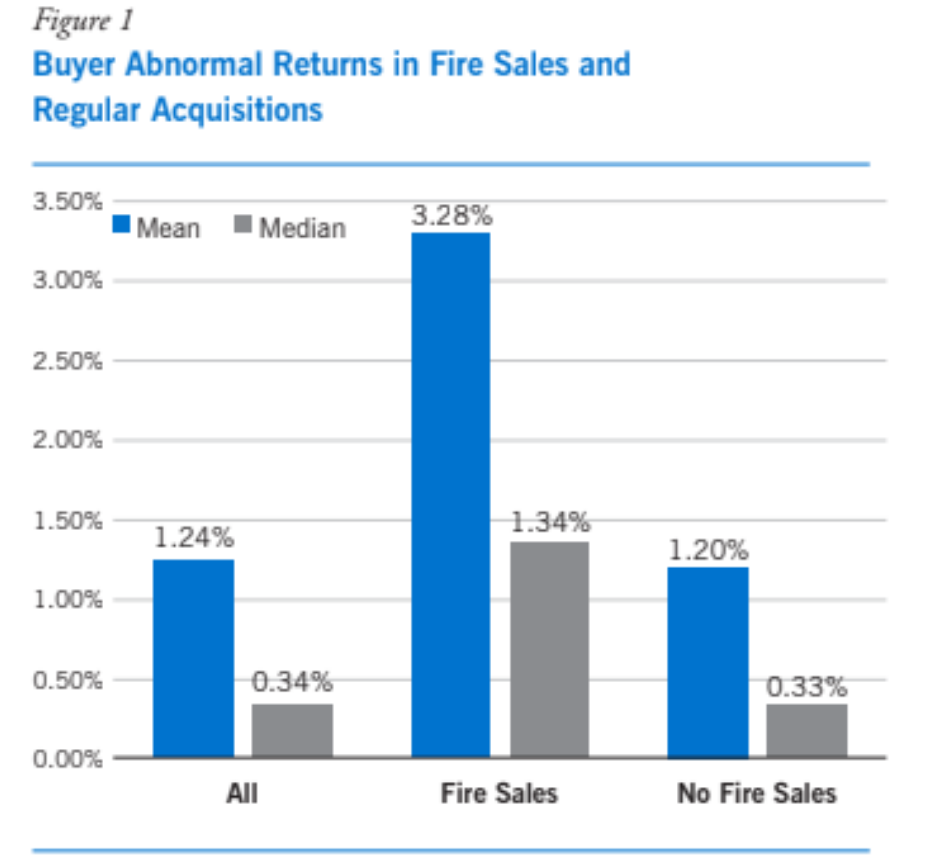

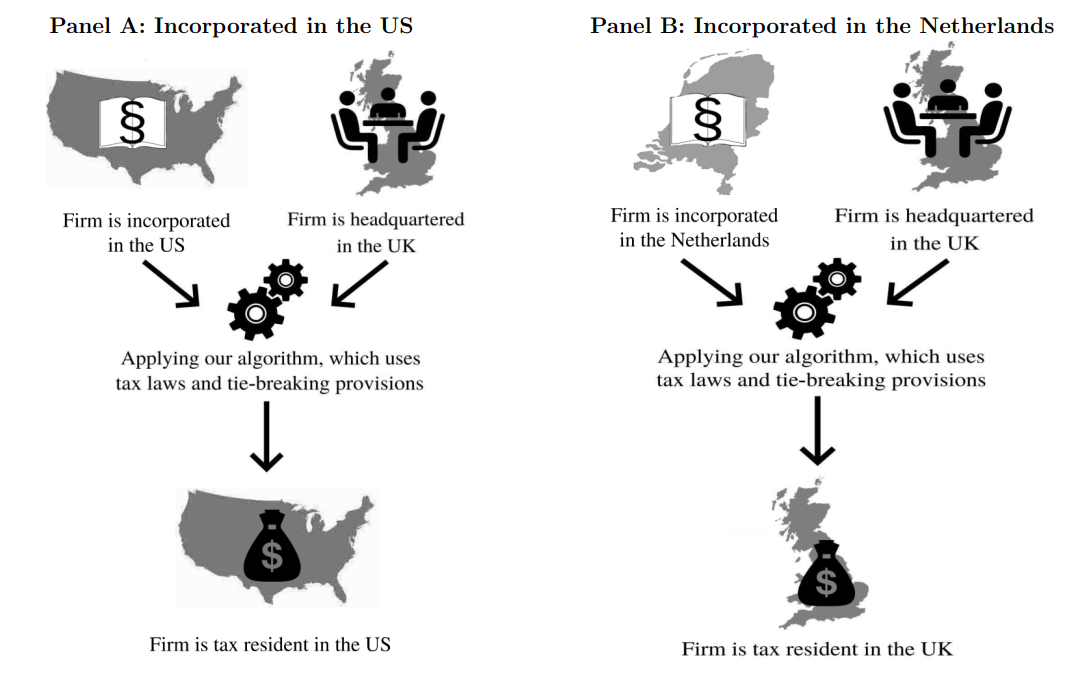

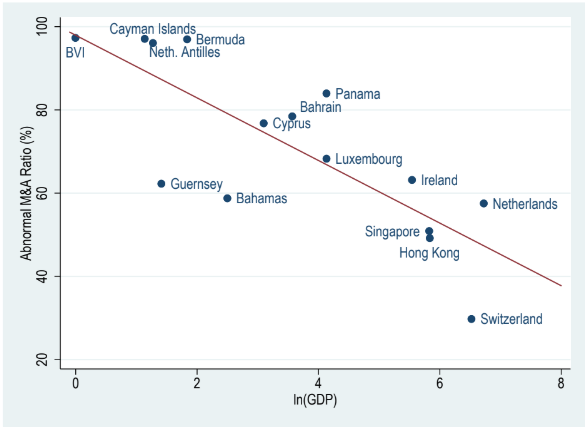

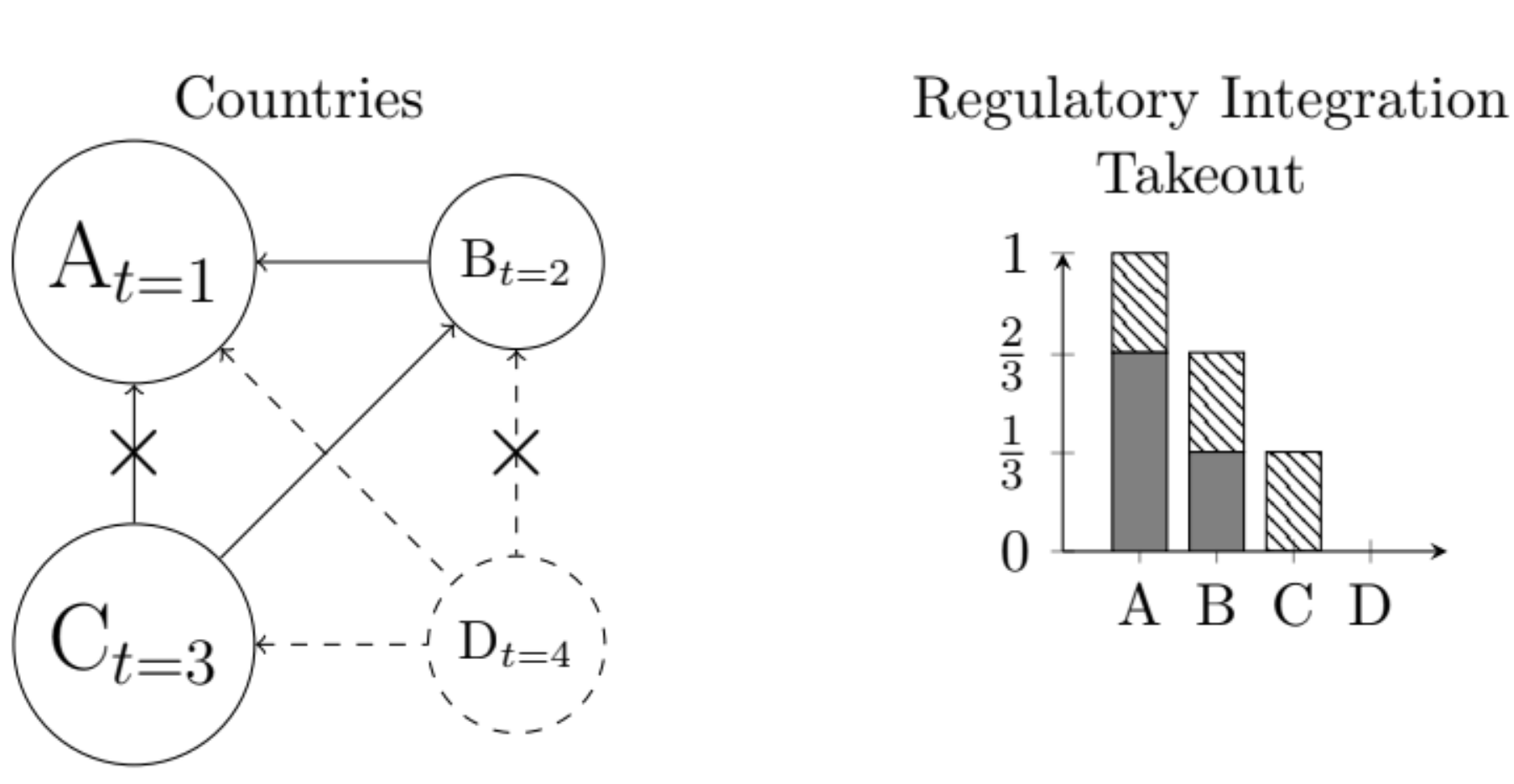

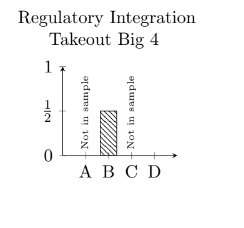

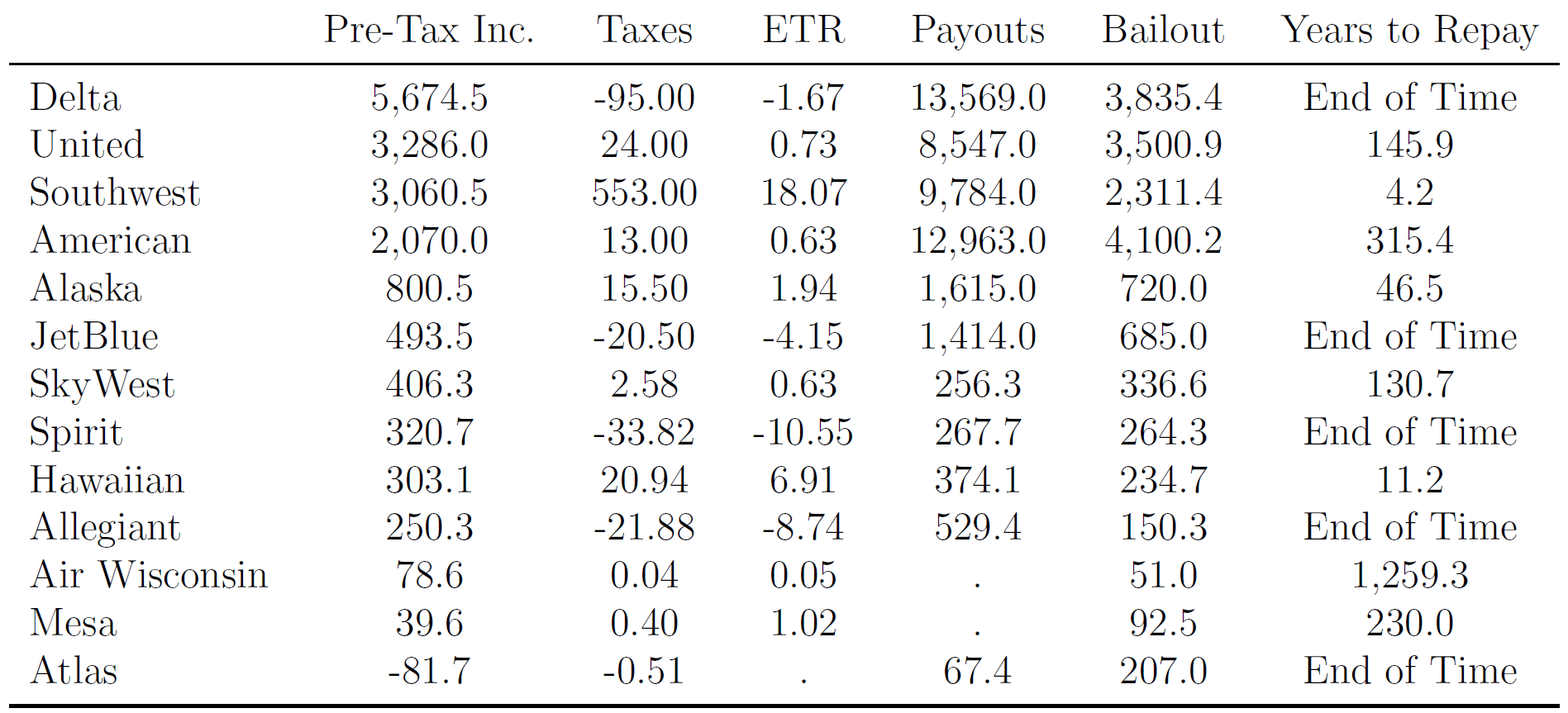

Jean-Marie Meier is Assistant Professor of Finance at the University of Texas at Dallas. He is a Fellow of the ESG Initiative at the Wharton School at the University of Pennsylvania. He was a Visiting Assistant Professor of Finance at the Wharton School at the University of Pennsylvania in the 2023/24 academic year. He was Finalist for the Jindal Faculty of the Year (Undergraduate) Award for the 2022/23 academic year. His paper “Improving the Measurement of Tax Residence: Implications for Research on Corporate Taxation” won the Best Paper in Corporate Finance Award at the SFS Cavalcade North America 2023. His paper “Regulatory Integration of International Capital Markets” received the Klaus Liebscher Award by the Oesterreichische Nationalbank (the Austrian Central Bank). He is the recipient of numerous other awards, grants, and scholarships. His main research interest is empirical studies in corporate finance. His work covers topics including international corporate finance, innovation & technology transfer, mergers & acquisitions, fire sales, geoeconomics, corporate taxation, and environmental, social, and corporate governance (ESG) issues. His papers often touch upon more than one of these topics. He received a Ph.D. in Finance from London Business School and an MSc Finance and BSc in Economics from the University of Mannheim in Germany. As an undergraduate and graduate student, he was a scholar of the German National Academic Foundation (Studienstiftung des deutschen Volkes).

For a short summary of my ESG research, see “Knowledge at Wharton.”